Complete the table to find the single deposit investment amounts – Embark on a journey to optimize your financial future with “Complete the Table to Determine Optimal Single Deposit Investment Amounts.” This comprehensive guide delves into the intricacies of single deposit investments, empowering you to make informed decisions and maximize your returns.

By exploring the factors that influence investment amounts, the table provided within this guide serves as a valuable tool for tailoring your investment strategy to your unique goals and risk tolerance. Discover how to leverage this table to determine the ideal single deposit investment amount for your specific financial aspirations.

Single Deposit Investment: Complete The Table To Find The Single Deposit Investment Amounts

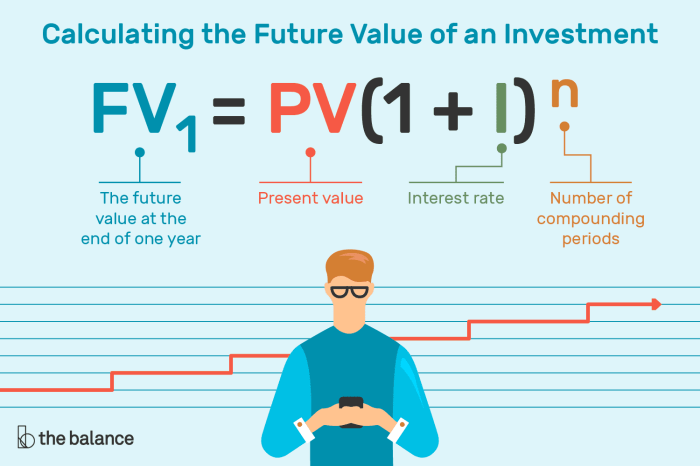

A single deposit investment involves investing a lump sum of money in a single transaction. It is a straightforward investment strategy that can be suitable for individuals with specific financial goals and a defined investment horizon.

Examples of single deposit investments include:

- Investing in a mutual fund

- Purchasing a certificate of deposit (CD)

- Opening a high-yield savings account

Factors Affecting Single Deposit Investment Amounts

The size of a single deposit investment amount is influenced by several factors, including:

- Financial goals:The purpose of the investment, such as retirement, education, or a down payment on a house.

- Risk tolerance:The investor’s ability and willingness to accept potential losses.

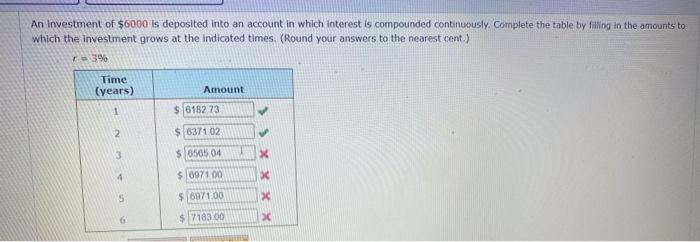

- Investment horizon:The length of time the investor plans to keep the investment.

These factors should be carefully considered to determine the appropriate amount to invest.

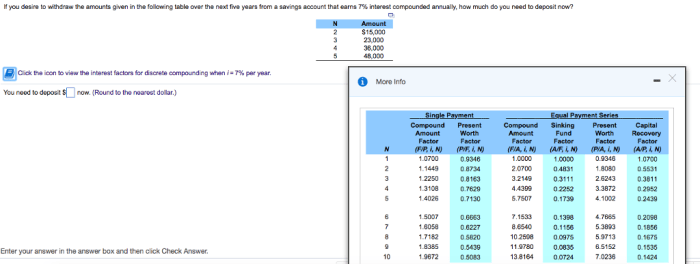

Table of Single Deposit Investment Amounts, Complete the table to find the single deposit investment amounts

The following table provides sample data for single deposit investment amounts based on different investment goals, risk tolerance, and investment horizons:

| Investment Goal | Risk Tolerance | Investment Horizon | Single Deposit Investment Amount |

|---|---|---|---|

| Retirement | Conservative | Long-term (10+ years) | $10,000

|

| Education | Moderate | Medium-term (5-10 years) | $5,000

|

| Down payment on a house | Aggressive | Short-term (less than 5 years) | $10,000

|

This table can be used as a general guide to determine the appropriate single deposit investment amount for a given situation.

Considerations for Different Investment Goals

When making a single deposit investment, it is important to consider the specific goals for the investment.

- Retirement:Investments for retirement should be made with a long-term horizon and a focus on preserving capital. Conservative investments, such as bonds or low-fee index funds, may be appropriate.

- Education:Investments for education can have a shorter time horizon and may tolerate more risk. Stocks or actively managed funds could be considered.

- Down payment on a house:Investments for a down payment on a house should be made with a short-term horizon and a focus on liquidity. High-yield savings accounts or short-term bonds may be suitable.

Risk Tolerance and Investment Horizon

Risk tolerance and investment horizon are two key factors that influence the single deposit investment amount.

Risk tolerancerefers to the investor’s ability and willingness to accept potential losses. Investors with a higher risk tolerance may consider investing in stocks or other growth-oriented investments. Investors with a lower risk tolerance may prefer bonds or other fixed-income investments.

Investment horizonrefers to the length of time the investor plans to keep the investment. Investors with a longer investment horizon may be able to tolerate more risk, as they have more time to recover from market fluctuations.

The table above can be used to adjust the single deposit investment amount based on risk tolerance and investment horizon.

Tips for Optimizing Single Deposit Investments

To optimize single deposit investments, consider the following tips:

- Consider tax implications:Choose investments that minimize tax liability, such as tax-deferred retirement accounts or municipal bonds.

- Diversify:Spread the investment across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

- Dollar-cost average:Invest the lump sum over a period of time to reduce the impact of market volatility.

By following these tips, investors can enhance the potential returns on their single deposit investments.

FAQ Summary

What is the purpose of the table in this guide?

The table provides a framework for determining the appropriate single deposit investment amount based on individual investment goals, risk tolerance, and investment horizon.

How can I use the table to optimize my investments?

By inputting your specific investment parameters into the table, you can identify the optimal single deposit investment amount that aligns with your financial objectives.

What factors should I consider when determining my investment amount?

Factors to consider include your financial goals, risk tolerance, investment horizon, and tax implications.